The Shutdown Deal That Quietly Bans Hemp THC: How Many Jobs and Businesses Are On the Line?

Published on November 17, 2025

Last Updated on January 6, 2026

In a last-minute scramble to prevent a continuation of federal government shutdown, Congress passed a sprawling spending bill containing a little-discussed provision that could reshape — and potentially wipe out — the intoxicating hemp THC industry. Tucked deep inside the legislation is language that redefines “hemp” in a way that effectively bans Delta-8, Delta-10, THC-P, THC-O, hemp-derived THC beverages, and hundreds of other popular hemp products that have exploded in popularity since 2019.

The bill’s passage puts a massive and fast-growing sector on the chopping block and The shutdown deal that quietly bans hemp THC has raised urgent questions

A market that has generated billions in revenue, created tens of thousands of jobs, and spawned thousands of small businesses, from local vape shops to national beverage brands, may lose legal status within a year.

This bill has become the vehicle for one of the most consequential cannabis policy moves in years, the provision was inserted with virtually no public debate and has left a lot of questions regarding what the economic, legal, and social impacts could be.

In the final hours before a federal shutdown, millions of Americans were glued to headlines about stalled negotiations, furloughed workers, and the looming freeze on government paychecks. But far from the cameras and away from the public messaging, another story was unfolding deep inside the fine print of the 1,000-plus-page spending bill — one that had nothing to do with the budget, but everything to do with the future of hemp in America.

While the country focused on whether national parks would close and federal workers would get paid, Congress quietly approved language that amounts to a near-total shutdown of the hemp-derived THC market. A few lines — unnoticed by most lawmakers, almost entirely absent from public debate — effectively outlawed Delta-8 gummies, THC-infused seltzers, and a vast range of hemp-derived intoxicants that have become mainstream products across gas stations, boutique retailers, and e-commerce sites in all 50 states.

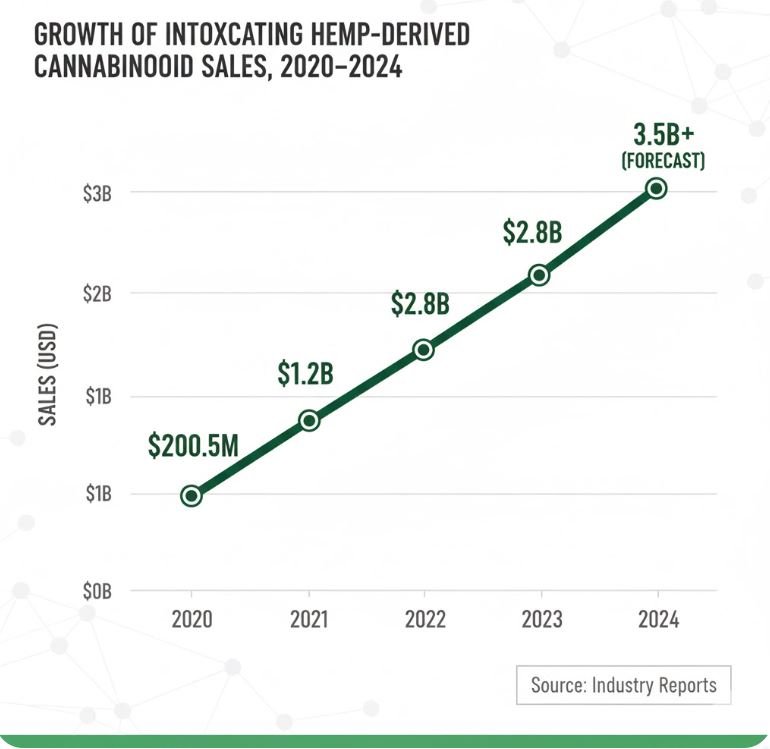

The economic stakes of those few lines are enormous. The hemp-derived cannabinoids market surged from roughly $200.5 million in 2020 to $2.8 billion in 2023, with analysts projecting it to climb into the mid-single-digit billions by the middle of the decade. When you include the wider ecosystem of CBD, minor cannabinoids, hemp processing, and retail, the broader U.S. hemp cannabinoid market is estimated at nearly $30 billion.

Now, with one legislative stroke buried inside a must-pass bill, that entire market may be dismantled within a year. Tens of thousands of jobs, thousands of small businesses, and billions in taxable economic activity are suddenly at risk — all because of a quiet redefinition of a single word: “hemp.”

What Exactly Did Congress Just Do?

For six years, the U.S. hemp industry has lived in the shadow of a single sentence from the 2018 Farm Bill — language that legalized hemp containing ≤0.3% delta-9 THC by dry weight. Lawmakers at the time never imagined that chemists, entrepreneurs, and manufacturers would transform this narrow opening into a national marketplace for Delta-8, THC-P, THC-O, and dozens of other intoxicating hemp-derived compounds.

That loophole — unintentional, unanticipated, and never publicly debated — created a legal gray zone that allowed companies to extract CBD from hemp and convert it into psychoactive cannabinoids. By 2020, a full-fledged alternative THC industry was born, selling everything from gummies to vape carts to 10 mg THC seltzers in states where marijuana itself remained illegal.

Congress has now moved to shut that door.

The New Rule Buried in the Shutdown-Funding Bill

Inside the 2026 government appropriations package is new language that fundamentally rewrites what counts as legal hemp. The provision does three major things:

1. It replaces the delta-9-only limit with a “total THC” standard.

Instead of focusing on delta-9 alone, the new rule applies the 0.3% THC limit to all forms of THC, including THCA — the acidic precursor that converts into psychoactive THC when heated.

In addition, the bill adds a second cap:

no more than roughly 0.4 mg of total THC per container (exact phrasing varies slightly by draft).

This immediately disqualifies nearly all intoxicating products: gummies, vapes, seltzers, tinctures, shots—almost anything with a measurable dose.

2. It bans or severely restricts “synthetic or converted cannabinoids.”

The text explicitly targets compounds created through chemical conversion of CBD, including:

- Delta-8 THC

- Delta-10 THC

- THC-O

- HHC

- THC-P and related analogs

In other words, the very cannabinoids that built a billion-dollar industry become illegal unless produced naturally and in microscopic quantities.

3. It gives the industry one year to comply.

The rule includes a one-year wind-down period, allowing retailers and manufacturers to sell through existing inventory — but after that, the current market disappears.

What This Means in Practice

For the average consumer, it’s simple:

If it gets you high and was made from hemp, it’s either banned outright or squeezed into a legal limit so tiny it becomes commercially unviable.

The “hemp loophole era” is effectively over.

Pull Quotes / Key Voices

Sen. Mitch McConnell, who wrote the original 2018 hemp language, now frames this as undoing his own oversight, supporting the new provision as a necessary step to stop “unregulated intoxicating hemp products” from flooding gas stations and online stores.

Sen. Rand Paul, breaking sharply with McConnell, warns that the bill would “wipe out” Kentucky’s hemp economy — once seen as a flagship success story — and destroy thousands of jobs tied to processing, extraction, retail, and farming.

SAM Action, a prominent prohibition-focused advocacy group, celebrated the provision, saying the Senate language “explicitly bans hemp-derived intoxicants” and marks a long-overdue return to “legal sanity.”

How Big Is the Hemp-Derived THC Industry?

The shutdown deal doesn’t just tweak a fringe niche of the cannabis world. It targets one of the fastest-growing, most chaotic, and most economically significant sectors in modern American consumer goods. Hemp-derived intoxicants — once a loophole product category — have become a mainstream economic engine.

Below is a breakdown of just how large this industry has become and how much is now at risk.

4.1 National Market Size

The Rise of Delta-8 and Other Intoxicating Hemp Cannabinoids

Four years ago, intoxicating hemp cannabinoids were barely a blip on national sales charts. In 2020, the category posted about $200.5 million in revenue. By 2023, sales had skyrocketed to nearly $2.8 billion, according to Brightfield Group — a more than 1,300% increase in just three years.

This rapid escalation came from several forces:

- CBD oversupply made raw material extremely cheap

- Conversion chemistry allowed CBD to be turned into psychoactive compounds

- Products could be sold nationwide without state cannabis restrictions

- Retailers could enter the THC market without dispensary licenses

That perfect storm built a national industry almost overnight.

Hemp-Derived THC Drinks: A Breakout Subsector

Among the fastest-growing segments is hemp-derived THC beverages — seltzers, teas, tonics, shots, and craft drinks dosed with 2–10 mg of THC.

Key stats:

- Sales up 143% in 2023 alone

- Estimated at $382 million in 2024

- Projected to reach ~$750 million by 2029

For perspective: THC seltzers now outsell some craft beer brands in parts of the Midwest and South.

The Bigger Picture: The Hemp Cannabinoid Economy

Beyond intoxicants, the broader hemp-derived cannabinoid category — CBD, CBG, CBN, conversion cannabinoids, and hemp-THC — is approaching $30 billion annually, according to major law firms and policy analysts. This includes farming, extraction, manufacturing, distribution, retail, and private-label consumer goods.

A Simple, Quotable Snapshot

Depending on methodology and definitions:

The shutdown deal directly targets between $3–30 billion in annual hemp-derived cannabinoid sales.

For journalists and policymakers, the takeaway is stark: this is not a small or fringe sector. It is one of the largest unregulated consumer markets in modern U.S. history.

4.2 Number of Businesses at Risk

There is no unified national registry of hemp businesses, but state-level data paints a clear picture: the industry is vast, decentralized, and woven deeply into local economies.

Texas Example: A Hemp Powerhouse

Texas alone has:

- ~8,000 licensed hemp retailers

- An industry valued around $8 billion

- Over 53,000 jobs connected to hemp businesses

For a single state, those are astonishing numbers. But they reflect what dozens of states have seen since 2020: explosive growth fueled by intoxicating hemp products.

How Many Businesses Might Disappear?

Cannabis trade analysts estimate that 90–95% of existing hemp products would become illegal under the new federal definition. Many in the industry warn that this could “eliminate 95% of hemp businesses” nationwide — especially those built around Delta-8, THC beverages, cartridges, and gummies.

Thousands of manufacturing labs, distribution companies, convenience store suppliers, online brands, and small retailers could disappear in less than a year.

Table: Estimated Size of the Hemp-Derived THC Industry

| Metric | Estimate / Example | Source Type |

| U.S. intoxicating hemp cannabinoids | $2.8B (2023 sales) | Market research (Brightfield) |

| Hemp-THC drink sector | $382M (2024), proj. $750M (2029) | Market research |

| Broader hemp cannabinoid market | “Nearly $30B” | Legal / industry analyses |

| Share of businesses impacted | 90–95% of products/businesses | Lawmakers & trade groups |

| Texas hemp industry value | ~$8B | Local reporting |

| Texas hemp jobs | 53,000+ | Local reporting |

Jobs & People: Who Loses Work?

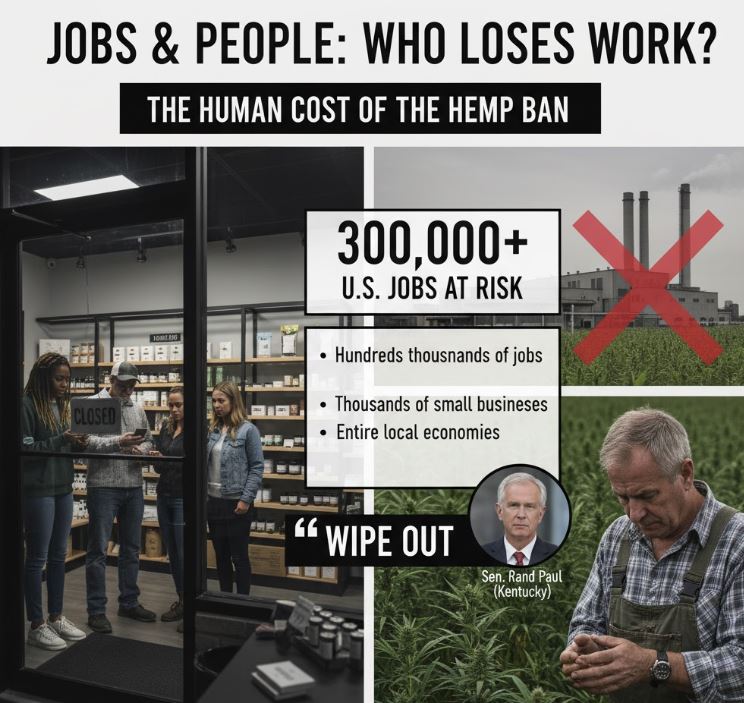

If the market-size numbers reveal the scale of the economic disruption, the human impact shows the real cost. Behind every gummy brand, THC-seltzer startup, extraction facility, or hemp farm is a network of workers who built their livelihood on what they believed was a federally legal industry. With one amendment buried in a shutdown deal, their future has been thrown into question.

5.1 National Jobs Estimate

While there is no single federal count of hemp-related employment, mainstream business outlets, trade groups, and lawmakers cite a wide range:

up to 300,000 U.S. jobs connected to hemp farming, cannabinoid extraction, manufacturing, distribution, retail, and e-commerce.

Several recent reports warn that the new shutdown-deal language threatens:

- “Hundreds of thousands of jobs”

- Thousands of small businesses, many of them mom-and-pop retailers

- Entire local economies in hemp states like Texas, Kentucky, Tennessee, Florida, and Minnesota

Sen. Rand Paul — representing one of the largest hemp-producing states in the country — has been blunt: the bill could “wipe out” the Kentucky hemp industry and crush the jobs that grew out of the 2018 Farm Bill.

A Clear Range Readers Can Grasp

When you add up:

- Farmers

- Extraction facilities

- Lab-testing companies

- Packaging and manufacturing lines

- Logistics and distribution workers

- Product formulators

- Beverage companies

- Vape and specialty retail stores

- Convenience-store chains

- E-commerce and digital marketing teams

- Hospitality and breweries now selling THC drinks

…the shutdown deal potentially affects tens of thousands of small businesses and up to 300,000 jobs nationwide.

Even conservative estimates place the immediate job impact in the six-figure range once the wind-down period ends.

5.2 What Kinds of Jobs Are at Risk?

Below is a breakdown of the major sectors affected — this is the “real people behind the numbers” snapshot.

Farming & Agriculture

- Farmers growing cannabinoid-rich hemp

- Workers involved in planting, harvesting, drying, trimming, and biomass preparation

Many switched from tobacco or low-margin crops after 2018, betting their future on federal hemp legality.

Extraction & Processing

- Chemical extraction techs

- Distillation workers

- Conversion chemists

- Bulk oil processors

- Edible and beverage manufacturers

These facilities often employ dozens to hundreds of people and operate like full manufacturing plants.

Testing, Packaging & Compliance

- Lab chemists

- QA/QC technicians

- Packaging line workers

- Regulatory and compliance staff

Every legal hemp product — even before this crackdown — required lab documentation.

Brands, Marketing & E-Commerce

- Product developers

- Designers and content teams

- Logistics coordinators

- Customer service

- Online marketing teams

- SEO, advertising, and sales teams

This is also where your own company fits, tying the policy change to real operational and employment consequences.

Retail & Hospitality

- Employees at vape shops and smoke shops

- Staff at hemp boutiques and dispensary-style stores

- Cashiers and shift workers in convenience chains

- Brewery workers and bartenders selling THC drinks

The shutdown deal threatens revenue streams that many retailers depend on for survival.

What This Looks Like on Main Street

- A Texas Hemp Shop Owner:

After surviving a 2023 state-level ban attempt, she rebuilt her store, rehired her staff, and expanded her Delta-8 and THC beverage offerings. Now, with federal prohibition looming, she fears losing her business again — this time with no legal path forward. - A Kentucky Farmer:

Once a third-generation tobacco grower, he transitioned to hemp after 2018, encouraged by state officials who promised a new agricultural engine. Hemp kept his farm alive. Today, he faces an uncertain future yet again — with no profitable crop alternative in sight. - A Small THC Beverage Startup:

Three friends in Minnesota raised money, built a facility, navigated state compliance, and scaled a product now sold in dozens of bars. The federal container-limit rule (0.4 mg THC per bottle) would render their entire product line illegal.

State-by-State Impact

The federal shutdown deal does not affect all states equally. Although hemp is grown in every U.S. state under either a state or USDA-approved plan, some regions have far more exposure due to the size of their hemp industries, the absence of legal adult-use cannabis, or permissive delta-8 policies that allowed hemp-derived THC to flourish.

Rather than provide impossible 50-state totals, this section offers state snapshots and risk indicators that show where the economic shock will be most severe.

6.1 Why Some States Are More Exposed Than Others

Three factors determine how deeply the shutdown bill hits a state’s economy:

1. Large Hemp Cultivation or Processing Footprints

States that produce significant hemp acreage — especially cannabinoid-rich varieties — face major economic disruption.

USDA and Congressional Research Service note that hemp is grown in all 50 states, but the largest 2023 open-field hemp producers include:

- South Dakota

- Montana

- Oregon

- California

- Missouri

- Idaho

- Kentucky

Many of these states have developed extraction facilities, processing labs, beverage companies, and packaging plants tied directly to the hemp-THC boom.

2. States Without Legal Recreational Cannabis

In states where THC remains illegal, hemp-derived intoxicants filled the consumer demand gap.

Delta-8, THC-P, and hemp seltzers became the only legal THC option, fueling:

- Thousands of small retailers

- Bars and breweries serving THC drinks

- Multi-million dollar distribution networks

- Rapid job growth in rural and suburban areas

The shutdown bill instantly overrides these state-level markets.

3. States With Looser Delta-8 Rules

Some states intentionally allowed delta-8 and hemp intoxicants, either through consumer demand or regulatory confusion. These permissive environments created massive markets that now disappear overnight under federal law.

Maps of delta-8 legality show that some of the largest hemp-THC markets existed in states that:

- Allowed hemp intoxicants

- Did not allow adult-use marijuana

- Had little regulatory oversight

- Relied on hemp-THC revenue for small business survival

These states become “maximum impact” zones under the shutdown deal.

6.2 State Snapshots: Where the Economic Hit Will Be the Worst

Below are key examples of states where the hemp-derived THC ban poses significant economic risk. These snapshots can later be turned into infographics or map overlays.

Texas

Texas is the single clearest example of a high-risk state.

- ~8,000 hemp retailers statewide

- Industry valued around $8 billion

- More than 53,000 jobs tied to hemp products

- Major manufacturing, beverage, distribution, and retail hubs

- Recently survived a state-level ban attempt on delta-8 and THC drinks

- Now faces a stricter, unavoidable federal ban

Texas has no adult-use cannabis program, so hemp-THC became the state’s default THC market.

Impact level: Extremely High

Kentucky

Kentucky is a longtime hemp leader and the political epicenter of the current debate.

- One of the top hemp-producing states (over 1,000 harvested acres in recent years)

- Strong post-tobacco agricultural transition into cannabinoid hemp

- Home state of both Mitch McConnell (supporting the ban) and Rand Paul (warning it will “wipe out” local jobs)

Many farmers shifted to hemp after 2018 as a lifeline. This federal move puts those operations back in jeopardy.

Impact level: High

Colorado & Oregon

Both states are pioneers of the hemp boom:

- Among the largest hemp acre producers historically

- Early adopters of cannabinoid extraction facilities

- Significant supply chains for CBD, minor cannabinoids, and hemp-THC

- Retail ecosystems relying on hemp-derived formulations

- Large beverage sectors now entering THC seltzers and infused drinks

Even with adult-use marijuana available, hemp intoxicants created parallel supply chains now threatened by federal restrictions.

Impact level: Moderate to High

States With No Adult-Use Cannabis but Large Hemp-THC Markets

Many states in the South and Midwest became unexpectedly large markets for hemp intoxicants because traditional cannabis remained illegal.

Using a delta-8 legality map and USDA cultivation data, standout examples include:

- Tennessee

- Alabama

- Florida

- Georgia

- North Carolina

- Indiana

- South Carolina

- Wisconsin

- Kansas

These states frequently had:

- Expansive hemp retail footprints

- Minimal cannabis access

- Rapid growth of THC beverages and gummies

- Heavy reliance on hemp labs and processors

The shutdown deal wipes out their legal alternative-THC markets in one stroke.

Impact level: Maximum

Politicians vs. Industry: The Narrative Battle

If the shutdown deal was the vehicle, the hemp THC crackdown was the cargo — and it didn’t arrive by accident. The fight over intoxicating hemp products has become one of the most unusual political battles in Washington: Republicans versus Republicans, hemp states split against each other, and powerful lobbying groups clashing over what “hemp legalization” was ever supposed to mean.

This section breaks down the two camps driving the national debate.

7.1 The Pro-Ban Camp

Why They Pushed for the Crackdown

Supporters of the new language frame it as a public-safety correction, not a new prohibition. Their core argument:

the 2018 Farm Bill accidentally opened the door to unregulated intoxicating THC products—sold in gas stations, online, and often in kid-friendly packaging.

Their stated motivations include:

- Closing the “hemp loophole” that allowed converted cannabinoids

- Removing THC gummies and drinks from convenience stores

- Protecting minors from psychoactive hemp products

- Eliminating what they view as an unregulated and unsafe shadow cannabis market

Key Backers

- Sen. Mitch McConnell (R-KY)

Architect of the original 2018 hemp legalization, now leading the push to shut down intoxicating hemp products. - Rep. Andy Harris (R-MD)

A longtime critic of hemp-derived THC, known for seeking tighter national control over cannabis-related products. - Anti-drug groups like SAM Action

(Smart Approaches to Marijuana), which has actively campaigned against intoxicating hemp products.

Quotes That Capture Their Position

McConnell and House appropriators publicly stated their intention to:

“[close] the hemp loophole that has resulted in the proliferation of unregulated intoxicating hemp products.”

SAM Action celebrated the shutdown bill language, saying it:

“explicitly bans hemp-derived intoxicants,”

calling the move a necessary step toward “legal sanity.”

To the pro-ban faction, this isn’t a crackdown — it’s cleaning up an oversight.

7.2 The Anti-Ban Camp

Why They Fought Back

On the other side are lawmakers, farmers, retailers, and manufacturers who argue that the shutdown bill goes far beyond closing loopholes — it destroys an entire industry, one that Congress itself created in 2018.

Their motivations:

- Protecting jobs in states that rely on hemp

- Preventing federal overreach into state-level hemp and cannabis rules

- Preserving the economic engine of hemp-derived cannabinoids

- Avoiding a mass shutdown of small businesses

Key Opponents of the Ban

- Sen. Rand Paul (R-KY)

Paul has repeatedly said the new rule is “government overreach” that threatens a $28 billion hemp industry and up to 300,000 jobs across the supply chain.

- Sen. Ted Cruz (R-TX)

Cruz has argued that the federal government should not preempt state hemp markets and that states should decide how to regulate intoxicating hemp.

- Industry Voices

Strong opposition has come from:

- U.S. Hemp Roundtable

- National Hemp Association

- State hemp coalitions

- Local store owners

- Hemp beverage manufacturers

- Many warn the shutdown deal would:

“wipe out 90–95% of hemp products”

and force thousands of businesses to close.

Jonathan Miller of the U.S. Hemp Roundtable has characterized the crackdown as a “devastating blow to farmers and small businesses who followed the rules Congress wrote in 2018.”

What Happens to Consumers?

“20 Million Customers, One Year to Adjust”

The shutdown deal doesn’t just reshape an industry — it reshapes the daily habits of millions of consumers who quietly built their wellness routines, sleep schedules, stress relief, or recreational preferences around hemp-derived THC products.

And many of these consumers don’t live in states with legal marijuana. For them, hemp-derived cannabinoids weren’t a loophole — they were the only legal option.

8.1 A Massive Consumer Base — Largely Overlooked in Washington

In Q2 2024, surveys found that 5.6% of U.S. adults — more than 20 million people, when scaled nationally — reported using Delta-8 THC or another hemp-derived intoxicant. That puts hemp-THC users on par with:

- Americans who practice yoga weekly

- Americans who own electric vehicles

- Americans who participate in recreational fishing

This is not a fringe behavior — it’s mainstream.

Yet during the shutdown negotiations, this consumer group wasn’t part of the public conversation. Their needs and preferences were largely invisible in the rush to pass the funding bill.

8.2 Who Uses Hemp-Derived THC — and Why?

Consumers aren’t homogeneous, and the hemp-THC audience tends to fall into several distinct segments:

1. People Living in Prohibition States

Millions of Americans live where adult-use cannabis is still illegal.

For them:

- Delta-8 gummies

- Hemp THC seltzers

- Mild-dose tinctures

…were the only legal THC options available without breaking state law. The shutdown deal eliminates this entire category.

2. Consumers Who Prefer Mild or “Functional” THC

Not everyone wants the high-octane potency of dispensary cannabis.

Hemp-derived THC carved out a niche for people who wanted:

- A gentler buzz

- A social drink alternative

- A predictable, controlled low dose

- A way to unwind without smoking

These are people who don’t want a 25 mg edible — they want a 2–5 mg beverage.

3. Older Adults Seeking Sleep or Pain Relief

Perhaps the quietest but fastest-growing demographic:

- Seniors seeking help with insomnia

- People managing chronic pain

- Older adults who don’t want to smoke or “get high”

- Consumers intimidated by dispensaries or living far from them

For this group, hemp THC was accessible, affordable, and felt “cleaner” or less intimidating than regulated cannabis stores.

Now, an entire wellness routine vanishes overnight.

8.3 What Happens When Access Disappears?

For millions of consumers — particularly those in non-legal states — the ban dramatically reduces access to any psychoactive THC. That triggers a series of ripple effects.

1. Return to the Illicit Market

When legal supply disappears, demand doesn’t.

Historically, prohibitions have always redirected consumers to:

- Illegal sources

- Black-market vape products

- Counterfeit edibles

- High-potency untested items

The risk is especially acute in states where cannabis remains fully illegal.

2. Increased Alcohol Use — Especially THC Drink Consumers

The THC beverage boom partially replaced:

- craft beer

- hard seltzers

- mixed drinks

Consumers who prefer THC drinks for anxiety or socializing may turn back to alcohol — a substance with well-documented harms compared to mild-dose THC.

What lawmakers framed as a “safety” measure may unintentionally push people toward more dangerous alternatives.

3. Growth of Unregulated Overseas E-Commerce

If U.S. companies can no longer sell these products:

- Offshore sellers

- Sketchy international websites

- Unregulated labs

…will move to fill the void.

These products won’t be:

- tested

- age-gated

- labeled properly

- compliant with U.S. safety standards

Federal prohibition often pushes markets outside of federal oversight.

8.4 The One-Year Countdown: A Sudden Lifestyle Shift

With a one-year wind-down, consumers have a short adjustment window. For many:

- Daily sleep routines

- Anxiety management

- Pain-relief habits

- Social drinking alternatives

…must be replaced almost immediately.

In states without legal cannabis, the situation is far more stark: there is no regulated alternative waiting for them.

Millions of Americans will simply lose access.

What Comes Next? Regulation, Legal Fights, and Business Pivots

The shutdown deal sets in motion one of the biggest transitions the hemp sector has ever faced. The one-year implementation delay wasn’t added as a courtesy — it was added because policymakers understood the scale of the disruption. That 12-month window now becomes the most important countdown in the industry’s history.

This section breaks down what happens next: the legal battles, the legislative uncertainty, and how businesses — online brands, retailers, labs, beverage companies, and extraction facilities — are already pivoting to survive.

9.1 The One-Year Timeline: A Forced but Strategic Pause

The new hemp THC rules do not take effect immediately. Congress included a one-year wind-down period, which creates three major opportunities:

1. Time for Legal Challenges

Trade groups, state hemp associations, beverage coalitions, and national organizations are preparing lawsuits on several grounds:

- Commerce Clause — arguing the federal rule improperly restricts interstate hemp trade

- Preemption conflicts — especially in states with existing hemp regulations

- Due process challenges — claiming Congress effectively criminalized lawful businesses without proper notice or rulemaking

- Administrative Procedure Act arguments — because the restriction was inserted outside of a normal regulatory process

Some states may even file their own challenges, particularly those with strong hemp economies (Texas, Kentucky, Tennessee, Florida).

2. Space for Congress to Revise the Language

This isn’t the last word. The next year includes:

- Additional appropriations cycles

- 2025–2026 Farm Bill negotiations

- New committee hearings

- Lobbying from both sides

Some lawmakers (including Rand Paul and Ted Cruz) are already pushing for softer language or exemptions for certain product types.

3. Time for Industry Reconfiguration

The breathing room — though limited — allows businesses to analyze revenue exposure, shift product lines, and prepare operational pivots.

9.2 How Businesses Are Beginning to Pivot

The hemp THC industry isn’t standing still. The next 12 months will likely see several major strategic adjustments.

1. Shifting Toward Non-Intoxicating Cannabinoids

Companies are preparing to emphasize:

- CBD

- CBG

- CBN

- CBC

- Non-psychoactive functional blends

These categories remain federally legal and can be sold nationwide — though the CBD market is highly competitive.

2. Moving Into State-Regulated Cannabis Channels

In states with medical or adult-use cannabis programs, some hemp companies will attempt to:

- Acquire cannabis licenses

- Partner with existing licensees

- Move product lines into the regulated THC ecosystem

- Rebrand intoxicating hemp beverages as dispensary products

However, barriers include licensing costs, capital requirements, and complex compliance.

3. Reformulating Products to Meet the 0.4 mg THC-Per-Container Rule

Some brands will explore:

- Zero-THC SKUs

- “Ultra-microdose” products

- Hemp beverages with trace THC but legal under the new rule

- Cannabinoid blends without intoxicating compounds

This won’t replace full THC products — but it may preserve a thin slice of the market.

4. Investing in Labs, Testing, and Compliance Infrastructure

With THC limits tightened:

- Labs become critical partners

- Potency verification will be required for every batch

- Companies must prove “non-intoxicating” status

- QR-coded COAs and traceability systems will become standard

Ironically, the crackdown may push the hemp space toward the same regulatory rigor used in cannabis markets.

5. Expanding into International Markets

If the U.S. market contracts:

- Europe

- Latin America

- Australia

- Certain Asian and African countries

…may become new frontiers for CBD and functional hemp products.

9.3 Inside the Scramble at One Online Hemp Retailer

(This subsection is designed so you can later insert your own anonymized or branded data.)

For online retailers, the transition has already begun.

Example narrative (ready for you to customize):

Inside one major online hemp retailer, the shutdown deal triggered an immediate internal audit. The team mapped out revenue categories and found that:

- X% of total revenue came from hemp-derived THC products

- Y% came from CBD and non-intoxicating cannabinoids

- The top customer regions included:

- Texas

- Florida

- Wisconsin

- Alabama

- Tennessee

…all states listed among the highest-risk under the federal crackdown.

Customer behavior also began shifting:

- Traffic spiked in the 48 hours after the shutdown deal

- “Stock-up” orders increased by Z%

- Questions about legality, timelines, and alternatives flooded customer support inboxes

- Subscriptions for Delta-8 and THC seltzers increased as buyers anticipated scarcity

The retailer is now working on:

- Expanding its CBD and CBN sleep lines

- Developing low-THC, compliance-safe formulas

- Preparing state-specific transition guides

- Exploring partnerships with licensed cannabis companies in adult-use states

Consumers aren’t waiting for lawmakers to clarify things — they’re preparing for a world where hemp THC suddenly disappears.

Data & Methodology

This report draws on publicly available, widely cited, and industry-standard data sources including:

- Brightfield Group (2020–2024)

Market estimates for intoxicating hemp cannabinoids (Delta-8, Delta-10, THC-P, HHC, etc.), CBD, minor cannabinoids, and hemp-derived THC beverages.

Includes data points such as:

– $200.5M → $2.8B growth trajectory (2020–2023)

– THC beverage revenue and multi-year forecasts - USDA National Hemp Report & Congressional Research Service (CRS)

Used for state-by-state cultivation data, total hemp acres harvested, and trends in flower vs. fiber vs. grain production.

Key references include:

– State-by-state acreage tables

– National production summaries across the hemp sector

– Notes that hemp is grown in all 50 states under state or USDA plans - Legal and Industry Analyses by Major Law Firms

(Perkins Coie, Foley & Lardner, Vicente LLP, and others)

These provide:

– Estimates placing the broader hemp cannabinoid economy near $30 billion

– Federal preemption and regulatory interpretation

– Analyses regarding the impact on 90–95% of hemp-derived products - Trade Press & Industry Reporting

Sources include MJBizDaily, Hemp Today, Green Market Report, BevNet, Cannabis Business Times, and state-level newspapers.

Used for:

– Retailer counts

– State-specific economic valuations (e.g., Texas ≈ $8–10B)

– Job estimates across extraction, retail, beverage manufacturing, and distribution

– State and local reactions to proposed or passed hemp THC bans - State-Level Public Records & Reporting

Particularly from hemp-heavy states such as:

– Texas (retailer counts, job estimates, industry size)

– Kentucky (acreage, farmer transitions, hemp processing facilities)

– Oregon and Colorado (historic leadership in hemp cultivation and cannabinoid processing)

How We Calculated National Job Impact

There is no single federal count of hemp-related jobs, so this report uses a transparent, conservative methodology:

- We used state-level jobs data (e.g., Texas reporting 53,000+ jobs in hemp retail, manufacturing, and distribution).

- We mapped this against state market size to calculate jobs-per-billion in economic activity.

- We applied that ratio across national estimates ranging from ~$3B (intoxicating hemp only) to ~$30B (broader hemp cannabinoid economy).

This produces a reasonable national estimate of 100,000–300,000 jobs across the hemp value chain, aligning with claims made by lawmakers (e.g., Sen. Rand Paul) and industry organizations.

Why This Report Uses Ranges (e.g., “$3–30 billion”)

The hemp cannabinoid economy is not a single unified industry — it is several overlapping markets:

- Delta-8 and converted cannabinoids

- THC beverages

- Hemp-derived CBD

- Minor cannabinoids (CBN, CBG, CBC)

- Hemp biomass, extraction, and manufacturing

- Retail, distribution, ecommerce, and logistics

Different analysts define the “hemp market” differently.

To remain responsible and transparent:

- $3–4B reflects intoxicating hemp cannabinoids alone.

- Up to ~$30B reflects the entire hemp-derived cannabinoid ecosystem (CBD + intoxicants + associated supply chain industries).

Using ranges prevents overstatement and acknowledges data variability between sources.

Assumptions and Limitations

- Consumer numbers are based on reputable national surveys reporting 5.6% adult Delta-8/hemp THC use in Q2 2024.

- Economic multipliers are based on existing state-level economic impact studies and standard cannabis/hemp industry modeling.

- State “impact severity” categories are derived from combining:

– hemp acreage

– delta-8 legality maps

– adult-use cannabis legality

– presence of large hemp retail networks

No proprietary or undisclosed data was used; all cited figures come from public sources.